Introduction

Parallel and inverse analysis of the spot forex can be used two different ways, when conducting the overall market analysis, and at the point of trade entry. Very few, if any, forex traders understand these concepts but as a forex trader the information is critical. If you do not understand parallel and inverse analysis you have almost no chance of being a successful forex trader, but your odds increase dramatically if you understand it well. It can be learned in a very short period of time.

Parallel and Inverse Analysis

Parallel and inverse analysis is the study of how individual currencies influence the movements of currency pairs and their intra-day movement cycles or within the context of a trend. It has also been called currency correlations and individual currency analysis. Few, if any, forex traders understand these concepts and essentially nobody is educating traders on this subject. However forex trading success would skyrocket if forex traders would master these concepts. Parallel and inverse analysis of the spot forex can be learned in about two to three weeks by any forex trader at any level.

Eight Major Individual Currencies

Here are the eight most widely traded individual currencies in the spot forex that we will examine in this article:

USD US Dollar

CHF Swiss Franc

EUR Euro

GBP British Pound

JPY Japanese Yen

CAD Canadian Dollar

AUD Australian Dollar

NZD New Zealand Dollar

Please note that an individual currency is not a currency pair, it seems very simple and fundamental but it is the crux of this entire technical paper and essential to learn forex trading. Remembering that a currency pair is comprised of two separate currencies will open your eyes to the pips.

Parallel and Inverse Pair Grouping Examples

An example of a parallel group of currency pairs is as follows.

EUR/USD

EUR/JPY

EUR/CHF

EUR/GBP

EUR/CAD

EUR/NZD

EUR/AUD

The EUR is on the left in all pairs and is the common individual currency.

An example of parallel and Inverse group of pairs is as follows:

GBP/CHF

AUD/CHF

NZD/CHF

EUR/CHF

USD/CHF

CHF/JPY

The CHF is on the right on all pairs but on the left on the CHF/JPY, the CHF is the common individual currency. This occurs on other currency pair groups. These are the very basics to learn forex and parallel and inverse analysis.

EUR/USD

EUR/JPY

EUR/CHF

EUR/GBP

EUR/CAD

EUR/NZD

EUR/AUD

The EUR is on the left in all pairs and is the common individual currency.

An example of parallel and Inverse group of pairs is as follows:

GBP/CHF

AUD/CHF

NZD/CHF

EUR/CHF

USD/CHF

CHF/JPY

The CHF is on the right on all pairs but on the left on the CHF/JPY, the CHF is the common individual currency. This occurs on other currency pair groups. These are the very basics to learn forex and parallel and inverse analysis.

Basic Discussion of How and Why Currency Pairs Move

First example:

If the EUR/USD is rising

and the USD/CHF is falling

then the USD weakness is controlling and "driving" the movement of both pairs, the USD is weak.

Second example:

If the EUR/USD is rising

and the USD/CHF is also rising

then the USD is not controlling the movement. The EUR strength is causing the EUR/USD to move higher and the CHF weakness is causing the USD/CHF to rise. In this case the EUR is strong and the CHF is weak so the best pair to trade would be to buy the EUR/CHF. The USD is completely out of the picture in the second example as far as what was driving the driving movement of the market.

These are two of the most basic examples. Not knowing this basic information represents the biggest failing of forex traders worldwide. Although this relationship between pairs and the real reasons for their movement being the movements of the individual currencies is simple and basic it escapes nearly every trader, although the logic is incredibly clear.

This simple, basic logic works for all 28 currency pairs derived from the eight most widely traded individual currencies in the spot forex listed above and can generate up to 500 to 1000 pips of forex trading profits in a single week of trading, if the market is trending on a lot of pairs.

Lets look at one more example using different pairs and currencies but the same logic.

If the AUD/USD is rising

and the USD/CAD is falling

then the USD weakness is controlling and "driving" the movement of both pairs, the USD is weak.But if both of these pairs are rising the USD is not controlling the movement and the best pair to trade would be to buy the AUD/CAD. This is the same logic as the EUR/CHF examples above but this time we are using different pairs and currency groups.

Once again, each currency pair has two individual currencies, by looking at other currency pairs in the same groups of pairs you can quickly determine what is driving the movement. In the case if the AUD/USD and USD/CAD example they are either moving in he same direction or opposite directions, or on some trading days not at all.

If the EUR/USD is rising

and the USD/CHF is falling

then the USD weakness is controlling and "driving" the movement of both pairs, the USD is weak.

Second example:

If the EUR/USD is rising

and the USD/CHF is also rising

then the USD is not controlling the movement. The EUR strength is causing the EUR/USD to move higher and the CHF weakness is causing the USD/CHF to rise. In this case the EUR is strong and the CHF is weak so the best pair to trade would be to buy the EUR/CHF. The USD is completely out of the picture in the second example as far as what was driving the driving movement of the market.

These are two of the most basic examples. Not knowing this basic information represents the biggest failing of forex traders worldwide. Although this relationship between pairs and the real reasons for their movement being the movements of the individual currencies is simple and basic it escapes nearly every trader, although the logic is incredibly clear.

This simple, basic logic works for all 28 currency pairs derived from the eight most widely traded individual currencies in the spot forex listed above and can generate up to 500 to 1000 pips of forex trading profits in a single week of trading, if the market is trending on a lot of pairs.

Lets look at one more example using different pairs and currencies but the same logic.

If the AUD/USD is rising

and the USD/CAD is falling

then the USD weakness is controlling and "driving" the movement of both pairs, the USD is weak.But if both of these pairs are rising the USD is not controlling the movement and the best pair to trade would be to buy the AUD/CAD. This is the same logic as the EUR/CHF examples above but this time we are using different pairs and currency groups.

Once again, each currency pair has two individual currencies, by looking at other currency pairs in the same groups of pairs you can quickly determine what is driving the movement. In the case if the AUD/USD and USD/CAD example they are either moving in he same direction or opposite directions, or on some trading days not at all.

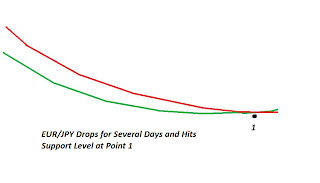

In this example above the EUR/JPY has been dropping for several days based on some simple trend indicators like exponential moving averages. There is a link at the bottom of this article to a set of simple trend indicators like these. You can check several EUR pairs or several JPY pairs over the same time period on the x-axis and quickly determine if the downward movement on the EUR/JPY over this time period was based on EUR weakness or JPY strength, or possibly both.

If the EUR/CAD, EUR/GBP, EUR/USD and EUR/CHF are all falling over the same time period then EUR weakness is driving the movement over this cycle. If the GBP/JPY, CAD/JPY and AUD/JPY are all falling over the same time period, then the JPY strength is the reason that the EUR/JPY dropped. This is incredibly simple but ignored by almost all forex traders.

Next the EUR/JPY stalls at support, Point 1 on the example chart. If it reverses back to the upside at Point 1 once again checking a few pairs will quickly tell you if EUR strength or JPY weakness is driving the EUR/JPY back up.

Now apply this logic to any one of 28 currency pairs comprised of the eight major currencies. Almost immediately you will start to understand why currency pairs move. You will also start to get many more pips out of your trading using the basic individual currency movements. This forex market logic presents itself daily to forex traders but almost no forex traders notice. The forex indicators and systems available now to forex traders do not take this simple logic into account and these systems are all fundamentally flawed.

Using Parallel and Inverse Analysis to Analyze The Forex Market

Now that we know the basics about parallel and inverse analysis lets move into some new concepts.When you analyze the forex market always analyze currency pairs as a group, by individual currency, not individually as a single pair. Currency pairs are not an island. Analyze all of the USD pairs together, then analyze all of the JPY pairs together, then analyze all of the CAD pairs together, etc. If you do this every day the trends of the market, oscillations and consolidation cycles will jump out at you right off of your charts and into your lap. If a particular group of pairs are all behaving the same way the market becomes a heck of a lot easier to trade. It is also very easy to spot choppiness or a more difficult market and you may consider not trading at all today, and with good reason.

Getting forex traders to do it this way is nearly impossible. But it is imperative to analyze pairs carefully. Doing so will allow you make better decisions as to when to trade and it will make a lot more sense as to why you should stay in your trades. For example if you buy the AUD/CAD and the AUD/JPY and AUD/USD are also trending up its alot easier to make an effort to stay in the trade for a longer period of time based on overall AUD strength. This concept works for any pair and thats why the method is solid.

Here is an example of how to correctly use parallel and inverse analysis to analyze the condition of a particluar currency pair. For example if you would like to conduct an analysis of the USD/CHF, you would first conduct an analysis of several USD pairs using multiple time frame analysis. Conduct multiple time frame analysis of the USD/CHF then repeat the analysis on the EUR/USD and GBP/USD, at a minimum. You would be looking for consistent strength or weakness, trends, oscillations, or movement cycles in the USD. In the event that there is no agreement in the 3 USD pairs you could also conduct an analysis of the GBP/CHF and EUR/CHF looking for consistent trends and movement cycles based on CHF strength or weakness.

By analyzing the USD and then the CHF you have completed your analysis of the USD/CHF. Is this what forex traders do?? No they do not, but it works and it work on any pair any day the forex market is open. Then you would know for sure whether or not the USD/CHF is trending or oscillating and whether the reason was USD strength or weakness or CHF strength or weakness, then you have done the analysis correctly and thoroughly. Most forex traders will not do this and most forex traders are not thorough. They want something that is quick like forex robots or forex news trading and they subsequently lose money. But doing it this way is totally logical and starts to reduce or eliminate entry risk of forex trades.

How Currency Pairs are Constructed

This section is incredibly basic but almost every forex trader is completely blind to it. It is a major failing of almost every forex trader.Most forex traders treat a currency pair like a single unit, or an island in the forex market. This is a huge error and almost every forex trader does this. They take a currency pair like the EUR/USD and treat it as a single thing, single object or single unit, which is a major and a massive mistake. This is not only a mistake but also a complete fallacy and a complete falsehood that leads to consistent failure.

The EUR/USD is composed of two individual currencies each with their own separate behavior, fundamentals, current condition, news releases, and reasons for moving up and down. In order to analyze the EUR/USD you must analyze the EUR currency separately and the USD separately.

Look at it this way, which is confusing:

EUR/USD

or look at it this way, which is much more accurate

EUR USD

This visual should tell you how to think about separating the two currencies in any pair for individual analysis.

The EUR and USD are two separate currencies that can both be weak, both be strong, or both be moving in opposite directions at any time in a trading session or within the context of the current market trends. I have tried and hopefully succeeded in proving this so far and especially in the section about market analysis just above this section.

The sum of the parts equals the whole and 1 +1 equals 2 in the forex. The minute you start to treat the EUR/USD as a single unit you have failed before you ever enter your first demo trade. The minute you start to view the EUR/USD as two separate currencies and analyze each currency separately then you not only have a chance to succeed with forex trading, but pips will begin to fall in your lap with some information that is obvious and incredibly basic but completely overlooked by almost all forex traders.

Now you can apply this same logic to any currency pair, it works.

Individual Currency Strength and Weakness

Now that you know how a currency pair is constructed lets investigate further.Almost all forex traders apply technical indicators to currency pairs, after you read this section of the article you may never do it again or you will at least wonder why you ever did it in the first place. I have literally seen forex traders take every technical indicator off their computer and charting system after realizing that what you are about to read below is true.

Back to the EUR/USD again. If you buy the EUR/USD the only way it will rise is if the EUR as an individual currency is strong or the USD as an individual currency is weak or both. The best scenario is both because the EUR/USD will appreciate the fastest under these conditions. This is also true if you buy Euros with US dollars at a currency cashier or buy the EUR/USD online with US dollars. It works the same way.

Buying the EUR/USD implies buying the left (base) currency and selling an equivalent amount of the right (quote) currency to pay for the base currency. For example, buying EUR/USD means that you are buying Euros and using US dollars to make the buy, or selling US dollars.

This concept must be fully understood or your forex journey will be short and you will "blow up" account after account and not know why. Technical indicators do not take individual currency strength or weakness into consideration. They never have and they never will and we have difficulties seeing how any technical indicator could work at all except for scalping. Scalping is not trading, scalping is scalping, and there is not a forex trader alive who will admit that they enjoy it.

There are over 150 technical indicators and over 100 candlestick chart types available to forex traders. But indicators do not drive movement on a currency pair. The only thing that drives movement on a currency pair is the currency strength or weakness of the two individual currencies that are in the pair, that's it, that is all, nothing else. In this regard technical indicators are somewhat worthless because none of the 250 indicators can measure this. Technical indicators are applied to pairs not individual currencies, and that is the failure point.

An analogy is this, the only way a car can move is if you step on the gas pedal, this is what actually causes the car to move. Individual currency strength and weakness is the gas pedal for a currency pairs, this is what makes them move. Technical indicators do not make currency pairs move they just "indicate". Indicators are nothing more than drawings on your computer screen.

Since technical indicators are applied to currency pairs, not individual currencies, people who use them are 99% likely to fail. The failure rate of forex traders is incredibly high and now everyone can see why.

I strongly suggest that forex traders start using parallel and inverse analysis to analyze individual currency groups, and individual currency pairs. Traders can also use parallel and inverse analysis of individual currencies also at the point of trade entry in lieu of technical indicators. This is the entire method and rationale presented here.

The entire forex industry is "steeped" in technical indicators and forex robots based on these technical indicators and slowly forex traders are getting fed up with all of this and looking for viable alternatives with credible logic behind them. These technical indicators originally migrated over from the stock market and stocks in no way behave like currency pairs nor are they constructed like currency pairs.

Trends in the Forex Market

An intermediate or longer term trend can be created by the day to day dynamics of the forex market. As an example lets say that the USD/JPY is consolidating sideways then starts an intermediate to long term uptrend and continues through that trend for a few weeks or a few months.

Throughout the course of the trend the movement drivers could be the USD strength or the JPY weakness on a day to day basis because the market dynamics can change day by day. In between the movement cycles the pair consolidates or retraces.

Almost no forex trader can explain what a trend really is on the forex, even people who claim to be a trend trader.

This is because they do not understand parallel and inverse analysis. A trend on a currency pair is nothing more than a long series of continuous market dynamics on both sides of the pair that favors movement in one direction. In order for the USD/JPY to build a trend that lasts for several weeks either the USD must be weak or the JPY must be strong or both throughout most of the period.

If you analyze the forex charts of other USD pairs or other JPY pairs during the period of time when the USD/JPY is trending at least one of those groups will be trending in the same direction. Parallel and inverse analysis wins again with obvious, simple and logical analysis. It wins every time because it is the logic behind the spot forex. Learn parallel and inverse analysis and you will learn to clearly identify and capture pips from forex trends.

This picture depicts a longer term uptrend on the EUR/JPY using simple trend indicators like exponential moving averages. The up trend forms off of the support. The black line represents the movement cycles and consolidation cycles on a conventional price chart like a bar chart, simplified with a black line chart. Each individual up cycle within the trend is either EUR strength or JPY weakness or both. Nothing else. Its that simple.

Remember that a trend on a currency pair is a long series of movements and market dynamics on both sides of the pair that favors movement in one direction. In this case each move off of support is EUR strength or JPY weakness. This works on all 28 pairs we follow.

Once again parallel and inverse analysis comes to the rescue. You now have some new thoughts and ideas as to how to spot a choppy market or choppy group of pairs using parallel and inverse analysis methods.

Generally speaking a ranging market can take on two forms. Currency pairs ranging up and down in large oscillations that are easy to spot and trade. Or tight ranging choppy markets that are so difficult to trade that its best to walk away. In a tight ranging forex market the drivers (market dynamics) change almost daily. One day the AUD is strong the next day the CAD is weak and the next day the USD is strong, etc., and it just continues for days and days. In a trending market the market dynamics change far less frequently. In a choppy market the individual currencies driving the movement change much more frequently or almost daily. Or else the same group of pairs moves in different directions on consecutive days. Once again each currency pairs has two sides, so either side of the pair can be driving the movement. If you can identify what parallel and/or inverse group is driving the market you can successfully trade every day. When do the drivers market switch??? They switch drivers during the intra-day consolidations that generally occur after the main trading session and USD session are complete.

If you are interested in buying or selling a particular currency pair and you read how to properly analyze the forex market you should be able spot a difficult to trade choppy market rapidly. If you conduct a multiple time frame analysis on the USD/CHF and you suspect it is choppy as evidences bu tight trading ranges down to the H1 and M30 time frames, immediately go to the other USD pairs and CHF pairs to confirm. If all of the USD pairs look the same or all of the CHF pairs look the same you have confirmed that that pair or group is choppy. You may still be able to trade another pair then check the USD/CHF again tomorrow.

If you are stuck analyzing and trading the same currency pair day after day without checking other pairs in the same individual currency families you will be ignorant of the market condition that exists on the same group of parallel and inverse pairs. This ignorance will result in stop out after stop out and you will never ascertain why the stop outs are occurring.

The reason you will be stopped out is a lack of market information which is clearly visible in a simple set of forex charts and trend indicators that you simply have not checked. These charts are right there on your computer but you have not checked them. You must look at the market deeper.

Conversely identifying a trending market will become much easier as well by checking the parallel and inverse pairs. If the USD/CHF looks like its in an uptrend a quick check of the USD and CHF pairs will confirm the trend. Your trading confidence will skyrocket. This is why all forex traders should review the condition of as many currency pairs as possible in your day to day market analysis routine in the same parallel or inverse currency families that you are interested in trading. Using multiple time frame analysis and drilling down the time frames will unveil what is going on with the pairs you are interested in trading. Combining the multiple time frame analysis with parallel and inverse pairs becomes very powerful and few, if any forex alert services utilize these analysis techniques.

You may not even trade some of the pairs you analyze but you will know what is going on in the market. As a trader that is your job, to know the condition of the market by examining the forex charts systematically to assist with your forex trading, entries, and trade planning. Identifying a choppy or trending market becomes much easier, and at some point, second nature.

Using Parallel and Inverse Analysis at the Point of Entry

Now that we know why pairs move and how to use parallel and inverse analysis to analyze the spot forex, we can now also apply this knowledge to trade entries.The number one question forex traders have is "When do I enter??", quite naturally. Once again parallel and inverse analysis will solve this problem. Entry management with parallel and inverse analysis is another application. After you analyze the forex market and you write up your trading plan, you can then set your price alarms at critical areas of support and resistance across some key pairs. Exact instructions to do this are in my article on support and resistance and price alarms.

When the alarms go off parallel and inverse analysis can be used for accurate trade entry management. Forex traders need to know when to get in, when to stay out, and when to look at another pair. They need an entry management tool that verifies the trade entry, and here it is:

This visual map of the spot forex is called The Forex Heatmap® and it tells you which individual currencies are strong and weak in real time, it utilizes parallel and inverse analysis to tell a trader what pair to enter and in what direction across 28 pairs. Its basis is parallel and inverse analysis and individual currency strength and weakness.

Throughout the trading week sometimes you can get a “slingshot effect” when a currency pair has a dual driver, one individual currency is strong and the other is weak. Here is an example….If the EUR is strong across the board (all EUR pairs are green on the heatmap) and the USD is weak across the board, then the EUR/USD will “slingshot” and move higher at a much faster rate. A pair with the volatility level on like the EUR/USD will move at least 150 pips under these conditions. Some of the GBP pairs can move 400 pips in one trading session. Trading with technical indicators is no longer necessary and after using a tool like this does not even seem to make sense anymore.

Summary and Conclusions

The vast majority of forex traders, almost all of them, don’t even know what parallel and inverse analysis is, much less understand it or use it daily in their forex market analysis or trade entries. I am asking all forex traders to become experts at parallel and inverse and use it to analyze the market and to verify your trade entries.

Forex traders will never realize the real profits of the market until they become experts at parallel and inverse analysis, which drives the movement in the entire market every day. Technical indicators and the forex robots based on the same technical indicators proliferate the forex trading communities and cause a lot of grief and trading losses. Forex traders want and need alternatives that work to produce solid pips. Thorough knowledge of parallel and inverse analysis will permanently change the way you think about the forex and give you solid a rationale as to why currency pairs move.